sales tax calculator buffalo ny

The current total local sales tax rate in Buffalo NY is 8750. Sales Tax State Local Sales Tax on Food.

New York Property Tax Calculator Smartasset

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

.png)

. The minimum combined 2022 sales tax rate for Buffalo New York is. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Sales tax applies to retail sales of certain tangible personal property and services.

Net Price is the tag price or list price before any sales taxes are applied. Groceries are exempt from the Erie County and New York state sales taxes. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

However all counties collect additional surcharges on top of that 4 rate. Ad Find Out Sales Tax Rates For Free. NY Sales Tax Rate.

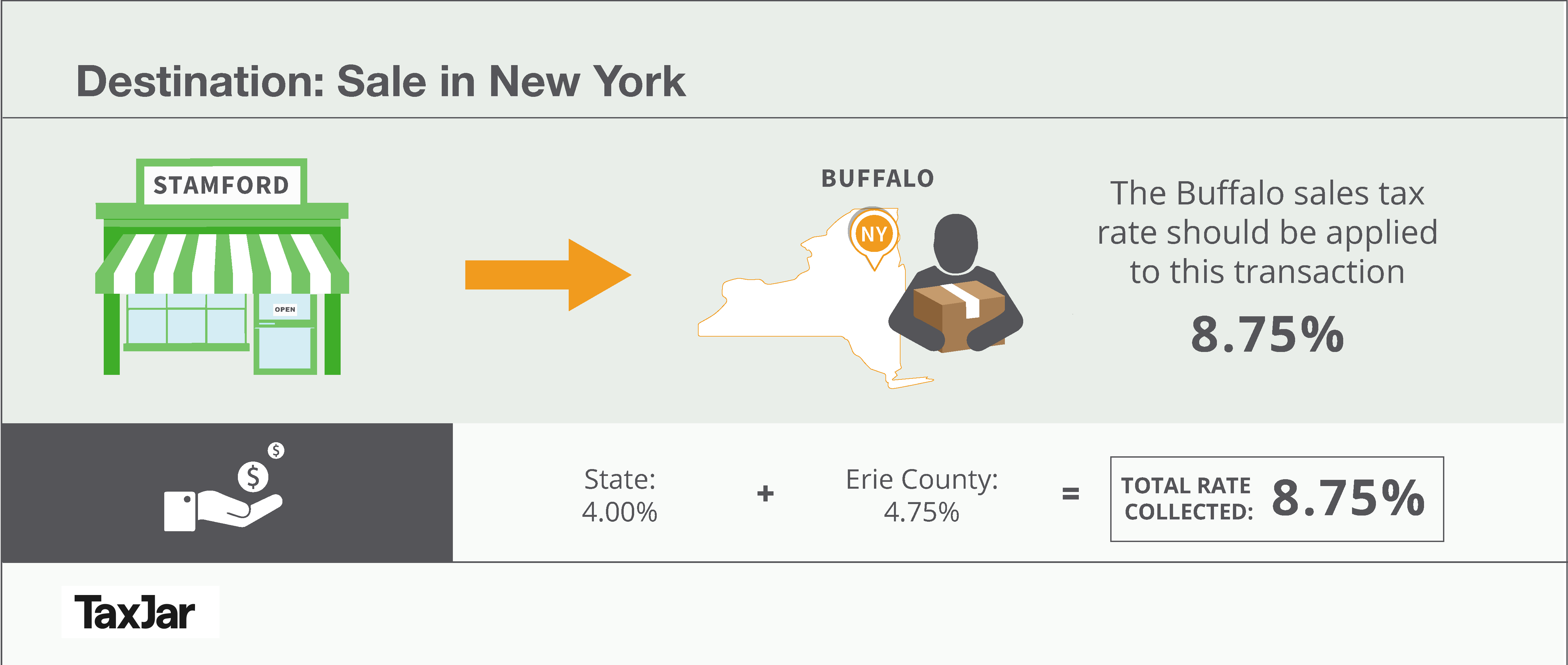

New York has recent rate changes Sun Sep 01 2019. The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. The Buffalo sales tax rate is.

NYS Petroleum Business Tax. For information on the Oneida Nation Settlement Agreement see Oneida Nation Settlement Agreement. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status.

With local taxes the total sales tax rate is between 4000 and 8875. Total Taxes NYS Sales Tax. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Federal Tax 0184. The December 2020 total local sales tax rate was also 8750.

For tax rates in other cities see New York sales taxes by city and county. At 4 New Yorks sales tax rate is one of the highest in the country. Total Price is the final amount paid including sales tax.

Use tax applies if you buy tangible personal property and services outside the state and use it within New York State. The Department issues the appropriate annual tax bill predicated on the final assessed value. Calculate a simple single sales tax and a total based on the entered tax percentage.

0080 Erie County Sales Tax. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD.

Real property tax on median home. Real property tax on median home. 0125 lower than the maximum sales tax in NY.

Sales Tax State Local Sales Tax on Food. Sales and use tax. The New York sales tax rate is currently.

Fast Easy Tax Solutions. The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax. Real property tax on median home.

New York NY Sales Tax Rates by City A The state sales tax rate in New York is 4000. Sales Tax State Local Sales Tax on Food. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4254 on top of the state tax.

Sales Tax State Local Sales Tax on Food. 00005 NYS Excise Tax. Living in New York City adds more of a strain on your paycheck than living in the rest of the state as the Big Apple imposes its own local income tax on top of the state one.

Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the City of Buffalo. There is no applicable city tax or special tax. Real property tax on median home.

Sales Tax State Local Sales Tax on Food. Overview of New York Taxes. The County sales tax rate is.

NYS Taxes 0342. Real property tax on median home. See reviews photos directions phone numbers and more for Sales Tax.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The table below shows the total state and local sales tax rates for all New York counties. Select the New York city from the list of cities starting with A below to see its current sales tax rate.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New York local counties cities and special taxation districts. For State Use and Local Taxes use State and Local Sales Tax Calculator. This means that depending on where you are actual rates may be significantly higher than other parts of the country.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Sales Tax Calculator in Buffalo New York with Reviews. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Buffalo NY.

The Erie County Sales Tax is collected by the merchant on all qualifying sales made within Erie County. This means that depending on your location within New York the total tax you pay can be significantly higher than the 4 state sales tax. You can print a 875 sales tax table here.

The Erie County New York sales tax is 875 consisting of 400 New York state sales tax and 475 Erie County local sales taxesThe local sales tax consists of a 475 county sales tax. This is the total of state county and city sales tax rates. Erie County Tax NYS Petroleum Testing Fee.

Online Sales Tax Compliance Ecommerce Guide For 2022

New York Vehicle Sales Tax Fees Calculator

New York Vehicle Sales Tax Fees Calculator

Minnesota Sales Tax Calculator Reverse Sales Dremployee

State Income Tax Rates And Brackets 2022 Tax Foundation

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

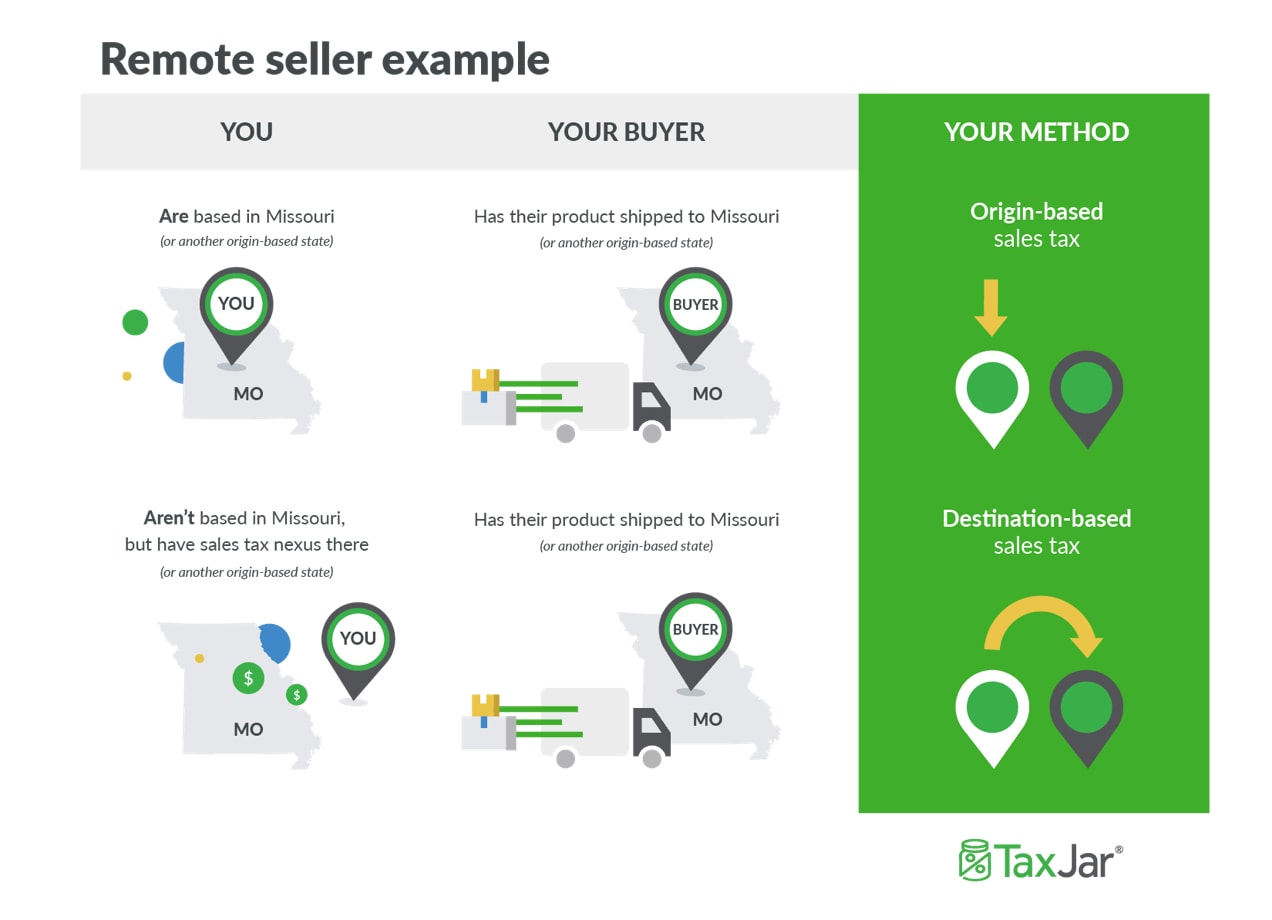

How To Charge Your Customers The Correct Sales Tax Rates

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Online Sales Tax Compliance Ecommerce Guide For 2022

Fact Or Fiction Millennials Are The Rent Generation Home Made Blog Millennials Baby Boomers Generation Make Blog

.png)

States Sales Taxes On Software Tax Foundation

Ny S Tax Climate Again Ranks At National Bottom Buffalo Niagara Partnership

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

New York Property Tax Calculator 2020 Empire Center For Public Policy