tax on unrealized gains india

President Biden said Friday he supports a. 1 day agoIndias crypto community is split over government plans announced last week to tax the volatile virtual asset the same way it taxes winnings.

Save Ltcg Tax On Stocks Businesstoday

It would affect people with 1 billion in assets or those who have reported at.

. A straight-forward way to end that game. So once you sell your Mutual funds and the funds are credited to your bank account you have to compute your tax liability and pay capital gains taxes on the same. Rather there is a proposal floating around that would impose a 15 minimum tax on all corporations as the former Alternative Minimum Tax was repealed in 2017.

Sure as India did remove their ability to deduct anything. Unrealized losses are only reportable to the extent that gains have been previously reported. As long as you dont try to tax their unrealized gains.

The Biden administration is looking to raise its tax revenue to fund a 35 trillion spending plan over ten years. Only in case of realized gains do you have to pay taxes in case of a mutual fund. Bidens Treasury Secretary said yesterday that she wants to tax the unrealized capital gains in order to pay for Bidens 35 trillion dollar agenda.

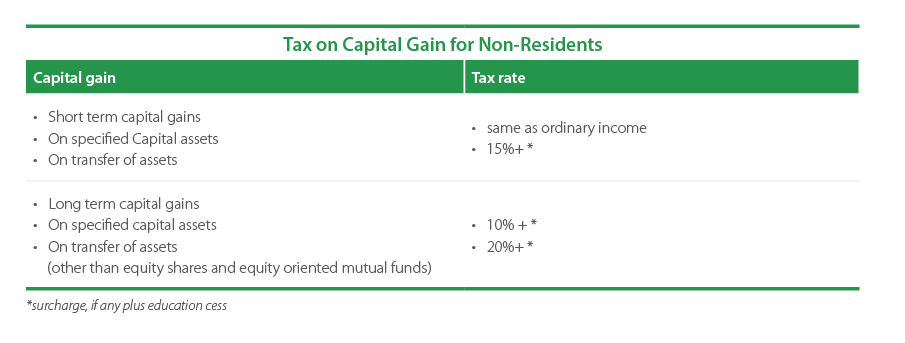

This method allows the shareholder to report the annual gain in market value ie unrealized gain of the PFIC shares as ordinary income on the other income line of their tax returns. Tax Breaks under section 80c to 80U is not available to Capital gain Income. However on the same day that India imposed high taxes on cryptocurrency Thailand chose to remove a 15 capital gains tax on cryptocurrency in response to widespread public outrage.

The adjusted basis for PFIC stock must include the gains and losses previously reported as. Interest income received by a foreign company is taxed at a concessional rate of withholding at 520 subject to conditions. You may still have to pay a tax on that 50 a share where you havent made a profit yet.

The top marginal tax. The Unrealized Exchange Gainloss arisen on account of any capital asset covered under Section 43A of the Act is not allowed to be added in case of loss or taxed in case of gain since Section 43A treats the same on REALIZATION BASIS. Yellen had first proposed the tax on unrealised capital gains in February 2021.

Tax the unrealized capital gains at death at the same rate wage earners pay. If your Income is comprised of Capital gains that come under a special tax rate you cannot save on tax outgo on the same by Investing in PPF Insurance Policies or even ELSS kind of products. Billionaires could be taxed on unrealized capital gains on their liquid assets Democratic officials said yesterday.

She wants investors to pay a tax on the increase in value of stock every year even if it is not sold. For companies engaged in manufacturing business and opting to pay corporate tax at the lower rate interest income shall be taxable 2517 including applicable surcharge and education cess. Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by Democrats as another step to make the rich pay for the uncontrolled spending by the federal government.

Poker chips that have not yet been exchanged for cash. The Madness Of Taxing Unrealized Capital Gains OpEd. And the value of their unrealized gains differs significantly about 100000 for the bottom 20 versus 17 million for the top 10 on average according to the Federal Reserve.

Until then it is play money an unrealized gain or loss that the government has no business putting their noses in. Capital gains tax in India Important rules to be aware of. So if a stock goes from 100 to 150 a piece in a year but you havent sold it.

Billionaires to pay taxes annually on unrealized capital gains has garnered wide. Wydens billionaire income tax. Biden backs taxes on unrealized investment earnings of billionaires.

An unrealized capital gains tax on. Where there are unrealized gains - no tax is payable as you have not booked any profits. House of Representatives Speaker Nancy Pelosi says Democrats hope the plan would raise as much as.

Bidens Treasury Secretary wants to tax the unrealized capital gains but heres why thats a terrible idea. You wont pay any taxes until you sell the share. More from Personal Finance.

Furthermore according to a recent report cryptocurrencies would be tax-free in. Tuesday October 26 2021. Senate Finance Chairman Ron Wyden D-Ore has pushed for years to enact the proposal which is one of several under consideration as part of Democratic efforts to cover the costs of Bidens 35 trillion budget reconciliation bill.

The gains on those assets - which are called capital gains - are taxed at a far lower rate than income brought in through wages. Gains that are on paper only are called unrealized gains For example if you bought a share for 10 and its now worth 12 you have an unrealized gain of 2. Yahoo Finances Denitsa Teskova breaks down Democrats new proposal to tax the wealthiest Americans.

Unrealized gains could be very important if you invest in funds however. Democrats unveil billionaires tax on unrealized capital gains. President Bidens proposal to require roughly 700 US.

Thats tax on unrealised capital gains. President Bidens proposal to require roughly 700 US. More employers put 401 k savings on.

Treasury Secretary Janet Yellen tells CNNs Jake Tapper that former Clinton and Obama. Or do something stupid like taxing. The capitalization under the Income tax Act is solely governed by the provisions of Section 43A of the Income tax Act 1961.

Mutual Funds In India Investment In Secured And Debt Instruments Tax Free Dividends In Hand Of Investor Subject Mutuals Funds Investment In India Investing

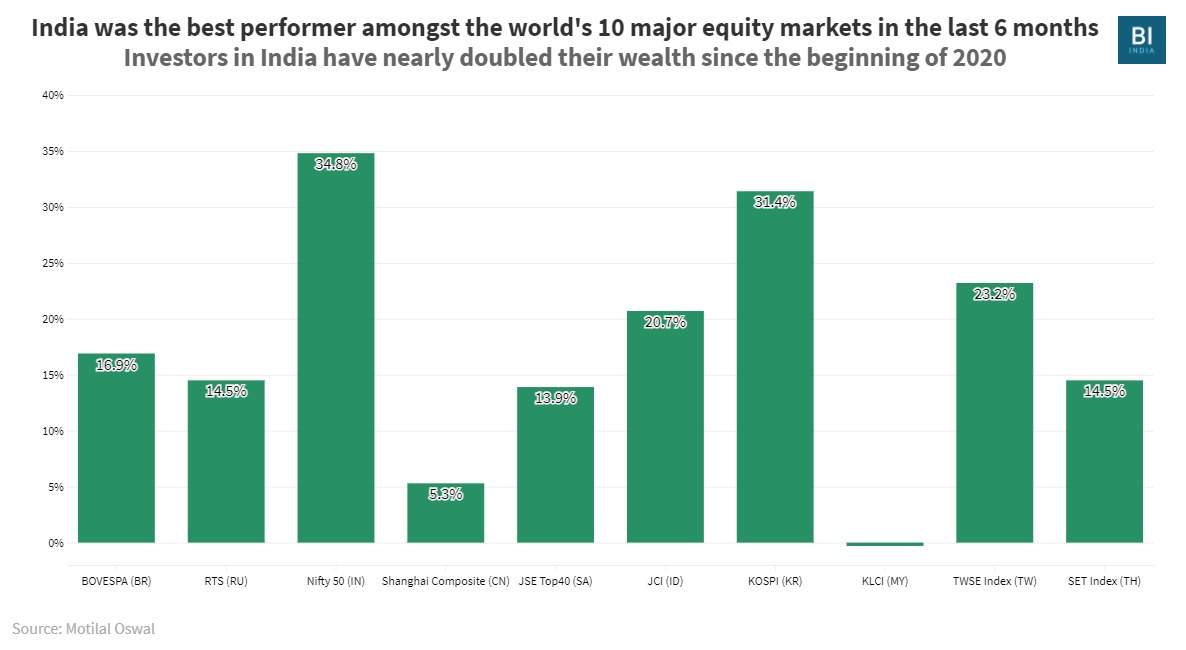

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Capital Gains Tax In India An Explainer India Briefing News

Should I Disclose Profits As Capital Gains

Do You Have To Pay Capital Gains Tax In India What Is Ltcg And Stcg

Explainer Income Tax Rules For Nris Who Invest In Stocks Mutual Funds In India

What Is A Long Term Capital Gains Tax In India Quora

Capital Gains Definition 2021 Tax Rates And Examples

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India